The Time is Right for US Expansion - But Do You Have the Right Strategy?

This month our look north and south across the Canada-U.S. border starts with getting an expansion to the U.S. right. As Paula Cruickshank, Senior Vice President, Ontario at the Business Development Bank of Canada shares, when the time is right for U.S. expansion, you need to ensure you also have the right strategy. Paula discusses how even when Canadian businesses are well positioned for U.S. expansion, having the right strategies and fundamentals in place is still critical for success. And she shares insights into how to get it right.

Author: Paula Cruickshank, SVP Ontario, Business Development Bank of Canada (BDC)

Canadian businesses are well positioned for U.S. expansion. But having the right strategies and fundamentals in place is critical for success. BDC Senior Vice President Paula Cruickshank shares insights into how to get it right.

It’s a great time for Canadian businesses to consider expansion into the U.S., and Canadian companies are well positioned to take advantage of the vast market south of the border.

Business leaders in Canada can leverage our shared language with the U.S., similar consumer preferences, proximity, close trade relations and Canada’s reputation for innovation and high-quality products.

But these advantages don’t mean Canadian companies should proceed without a carefully considered plan. The U.S. is a very large, highly diverse country with a competitive landscape. Expanding can be costly in terms of resources, effort and time. Making such a big investment in an ad hoc way can lead to expensive mistakes and lost opportunities.

Planning is essential

To help ensure a successful U.S. expansion, it’s important to have the right strategies and fundamentals in place.

One of the most common mistakes that Canadian businesses make is to assume they know the U.S. and don’t need any special preparation to expand. After all, aren’t Canada and the U.S. about as similar as any two countries can get to each other? We watch the same TV shows and movies and listen to the same music, after all.

This assumption often leads to serious missteps. The U.S. isn’t a single, homogeneous market. Its many states and regions have a wide variety of different consumer tastes, regulatory environments, laws, logistics and business cultures. That’s why some homework and planning are essential to improve your odds of success.

At BDC, we work with many successful Canadian exporters and and can help businesses with International Expansion, including to the U.S. Benefitting the most from a U.S. expansion often boils down to a few common ingredients.

“Americans may be skeptical about dealing with a non-U.S. company. How will you win them over and differentiate yourself?”

Review your company

Before expanding it’s important to step back and review your company. Do you have the resources to expand to the U.S.? Will you be ready to fulfill larger U.S.-sized orders? You may have to wait some time for cash inflows. Until then, do you have the financial resources in place to invest in needed machinery, personnel and material?

You also need to have a think about how you’ll adapt your products or services to U.S. tastes and requirements. Americans may be skeptical about dealing with a non-U.S. company. How will you win them over and differentiate yourself?

Canadian companies often lag behind the U.S. in using technology and productivity. How digitally mature and operationally efficient is your business? Your business should have strong fundamentals to be competitive in the U.S. You can use BDC’s free online digital maturity tool and operational efficiency quiz to gauge where you stand.

It’s probably a good idea to invest in improvements before you embark on an expansion. At least get the ball rolling. Better to invest ahead of time than to find out after the fact that your U.S. competitors have a major edge on you.

“Make sure your team is ready to expand. Is everyone in agreement on the benefits for your business?”

2. Assemble your team

Make sure your team is ready to expand. Is everyone in agreement on the benefits for your business? Do you have employees or outside advisors who are familiar with the U.S. landscape? Your success may depend a lot on personal connections and a good knowledge of the target market.

Be sure to have advisors who can help you navigate legal, human resources, accounting, distribution, logistics and marketing issues.

It’s important for entrepreneurs to be able to delegate and assemble a team to lay the right groundwork for growth. Find employees who can fill in your expertise gaps, then empower them to make decisions. As a business leader, your job isn’t to micromanage, but to set the vision for where the company will go.

Bringing together the right team is more challenging because of Canada’s labour shortage—a difficulty that U.S. businesses face too. BDC research has found that the best solutions are:

Investing in technology, digitization and automation.

Developing a people strategy and ensuring you’re an attractive employer.

Fostering an inclusive, diverse and engaged work environment and expanding your hiring pool to underrepresented groups, such as racialized people, new immigrants, Indigenous People, older people and people with disabilities.

3. Develop a market entry strategy

A market entry strategy is a must. This is where you do market research to identify specific U.S. states or regions that would be a good fit for your company. You can use trade data from such free online tools as the Canadian government’s Trade Data Online website or the U.S. Department of Commerce’s TradeStats Express site. BDC will follow its clients to about 20 different U.S. states (somewhere in this paragraph).

In most cases, we recommend starting small. Choose one state or region to target initially, then expand from there. You can deepen your knowledge by hiring an expert on the target market and attending trade shows, business events or trade missions.

“Logistics is a complex process that may require specialized expertise and good partners.”

4. Plan logistics and distribution

Think about logistics and distribution. Planning ahead will reduce the risk of costly problems down the road. You’ll need to consider:

Distribution—Will you use a distributor or agent, create a physical presence, sell online or use a multi-channel approach? Will you stock some products locally or ship directly? If the latter, you’ll have to sort out who will pay for duty and shipping.

Transport—Logistics is a complex process that may require specialized expertise and good partners, such as freight forwarders, carriers, customs brokers and insurance providers.

Intellectual property—Consider any intellectual property issues, such as IP ownership and employment contracts, IP indemnification and how to protect data. The Trade Commissioner Service offers a useful webpage on IP issues for Canadian businesses expanding to the U.S.

Packaging, documentation and labelling—You may need to adapt packaging to different consumer tastes and so that your product is protected during shipping. Also be sure to find out about documentation and labelling requirements.

Expanding to the U.S. is a fantastic opportunity that should be seriously considered by Canadian companies looking to grow and scale. With the right preparation beforehand, business leaders can significantly improve their chances of making a winning investment.

For more information on BDC, please visit our website: https://www.bdc.ca/en

2024: A Year to Embrace the Evolution of the Logistics Industry

And when it comes to getting goods to and throughout Canada, there is no organization more fully invested in getting this right than Purolator International. Paul Tessy, Senior Vice President, puts the role of logistics companies in a global context in his article. Consider all of the whitewaters that getting goods into a consumer's or customer's hands must navigate. Supply chains are being moved out of China. The explosion of e-commerce. The rise of machine learning. Fierce competition for skilled workers. Evolving consumer expectations. The certifiable march toward corporate sustainability. This decade, logistics companies have faced the need to contend with an influx of change. In his article, Paul Tessy reviews evolving industry conditions to talk about what is in store for 2024.

Author: Paul Tessy, Senior Vice President, Purolator International

Supply chains being moved out of China. The explosion of e-commerce. The rise of machine learning. Fierce competition for skilled workers. Evolving consumer expectations. The march toward corporate sustainability.

This decade, logistics companies have had to contend with an influx of change, much of it beyond their control. Now, looking ahead through 2024, it’s clear that evolving industry conditions are the new normal, and companies must be prepared to pivot where needed.

With that in mind, here are the key trends I believe will shape the rest of this year and beyond:

1. Shaking up global supply chains

The biggest source of change in logistics is in our supply chains. I’m seeing three key trends playing out now, and in the many months ahead.

Nearshoring: This phenomenon is picking up tremendous steam as companies bring their production closer to home, to nearby countries with similar time zones. To minimize disruptions to supply chains caused by the questionable durability of global trade agreements and norms, we’re seeing the reverse of what happened when companies outsourced production to China in the 1990s.

"As business models change, expect more and more reshoring, nearshoring, vertical integration, and increased sourcing from new geographies. This is particularly true alongside economic signals such as China’s pivot away from manufacturing toward a service economy. Clearly, the cross-border trade and investment between Canada and the U.S. will take on an even greater role than ever."

As business models change, expect more and more reshoring, nearshoring, vertical integration, and increased sourcing from new geographies. This is particularly true alongside economic signals such as China’s pivot away from manufacturing toward a service economy. Clearly, the cross-border trade and investment between Canada and the U.S. will take on an even greater role than ever.

Changing market demographics: In the U.S. alone, consumers are spending nearly US$60 billion for on-demand services such as online marketplaces and transportation. This is driving high demand for custom goods and fast delivery even while companies seek growth opportunities in new markets and new customer groups.

I expect such dynamics to push plenty of businesses to situate manufacturing closer to end customers. As a result, by next year, many supply chains will shift toward national, regional, and even local networks of buyers and suppliers.

Automation: Advancing technology will further influence the digitization of supply chains, how products and services are made and delivered, and managing supply chain data in new ways. Companies will revolutionize their supply chain management through innovations in machine learning, blockchain, and augmented reality.

Ultimate transparency is the name of the game, particularly as suppliers, workers, and communities focus on measuring and reporting on environmental and social performance.

Partnering with companies that have the technology and tools to drive value, simplicity and efficiency is key to manage the challenges that can come with these trends. For example, offerings such as web portals and virtual assistants can provide unparalleled access to shipment visibility, support and issues resolution, resulting in seamless customer access and experience.

2. An increased push for sustainability

Environmental sustainability needs no introduction at this point, but when it comes to trends affecting the logistics industry in 2024, few are as widespread as this one.

First, we know that climate change puts vulnerable supply chains at much greater risk, due to a reliance on raw materials and in geographic areas that are being impacted by an increasingly warming climate.

Second, we know that modern consumers care about the carbon footprint of companies they endorse through their wallets. They want to know if a brand puts sustainability first, including all the way through its value chain. More people are adopting greener lifestyles and purchasing sustainably sourced products. One PwC report found that half of all global consumers say they’ve become more eco-friendly.

Sustainability is no longer a nice-to have offering; indeed, it is quickly becoming a key factor in carrier selection. Furthermore, there is real economic value in getting out ahead of sustainability efforts before regulatory mandates are imposed. It is imperative that every logistics company embeds purposeful sustainability objectives in strategy and operations planning throughout this decade.

"We recognize that customers and stakeholders value action on sustainability, which is why Purolator is committed to reducing its Scope 1 and Scope 2 emissions by 42 per cent, diverting 70 per cent of waste from landfill and reducing emissions from electricity use by 100 per cent this decade. This is all in pursuit of our mission to achieve net-zero by 2050."

Purolator is leading the way in Canada, making continuous investments toward reducing our environmental impact. As a transportation leader, we have focused on our area of greatest impact: fleet decarbonization. We started with hybrid electric vehicles before introducing all-electric vehicles in 2020. Last year Purolator rolled out a plan to decarbonize our Canadian network, pledging $1 billion to electrify 60 percent of the last-mile fleet by 2030. We recognize that customers and stakeholders value action on sustainability, which is why Purolator is committed to reducing its Scope 1 and Scope 2 emissions by 42 per cent, diverting 70 per cent of waste from landfill and reducing emissions from electricity use by 100 per cent this decade. This is all in pursuit of our mission to achieve net-zero by 2050.

Companies must begin their sustainability journey by planning for the nuts and bolts of this transition, from infrastructure to supply chains to technology needs. The shift must also align with overall corporate values and be well-communicated to all internal stakeholders. Keep in mind that meaningful change requires a long-term commitment, and managing such change needs a lot of care and patience while navigating through impacts on operations.

3. Prioritizing the employee experience

Workforce challenges will continue this year, aggravated further by cost pressures. Some roles will be particularly onerous: take freight transportation, for example, with the ongoing shortage of long-haul delivery drivers.

The result is that all companies will need to evaluate hiring practices and both build and promote a positive company culture so that they can attract and retain skilled employees. Competition in the logistics industry is fierce – we are seeing this not only in labor-intensive jobs in transportation and warehouses, but also with knowledge workers (especially in light of the automation technology being a greater focus as noted above).

"Companies are best to put in place technology to improve the employee experience and tools, resources and programs so they can develop and grow their skills. These are essential to attracting and retaining skilled professionals to support all sets of workers who must manage supply chains as well as the technology to move things forward."

Companies are best to put in place technology to improve the employee experience and tools, resources and programs so they can develop and grow their skills. These are essential to attracting and retaining skilled professionals to support all sets of workers who must manage supply chains as well as the technology to move things forward.

A focus on physical and mental health in the workplace is similarly essential, and there are plenty of great resources out there (like this one) from which to build strategies. Companies are in a unique position to meet these needs head-on by being willing to prioritize the well-being of their most valuable asset: their people. The benefits of doing so are many, both for a worker’s personal well-being and for their overall work performance. Engaged and motivated employees make better decisions, foster a culture of continuous learning, and promote creativity, resilience and innovation. It also cuts down the rising and expensive threats of burnout, absenteeism and turnover.

Across the industry, more is being expected of companies as places not only to earn a paycheck, but to find a sense of belonging and safety.

Opportunities ahead

I believe these trends in the logistics industry are the ones whose influence will be greatest here in 2024, and certainly looking ahead as well. While each possesses challenges, they also offer important opportunities.

Staying operationally flexible will be key in order to embrace change as it comes – rather than reacting in ways that compromise parts of the business, the brand or the culture. That will position companies well to meet the spiking demand for logistics and transportation assets in today’s climate.

For more information on Purolator International, please visit our website: https://www.purolatorinternational.com/

The Fighting Against Forced Labour and Child Labour in Supply Chains Act

You may not be aware that 2024 ushered in Canada's modern slavery legislation, the Fighting Against Forced Labour and Child Labour in Supply Chains Act which came into force on January 1, 2024. With the Act, Canada introduced reporting obligations to combat modern slavery in the supply chains of many businesses and other "entities" with connections to Canada. Lindsay Clements and Jennifer Wasylyk, Partners at Cassels Brock & Blackwell LLP, profile this important legislation for us.

The Fighting Against Forced Labour and Child Labour in Supply Chains Act

Authors: Lindsay Clements, Partner; Jennifer Wasylyk, Partner, Cassels Brock & Blackwell LLP.

On January 1, 2024, Canada’s modern slavery legislation, the Fighting Against Forced Labour and Child Labour in Supply Chains Act (the Act), came into force. With the Act, Canada introduced reporting obligations to combat modern slavery in the supply chains of many businesses and other “entities” with connections to Canada.

Given the fast-approaching deadline (of May 31, 2024) for the initial report under the Act, businesses should prioritize determining whether they have a reporting obligation under the Act and, if so, gathering the information that they require in order to prepare their initial report.

Who does the Act apply to?

The Act applies broadly to “entities” that:

produce, sell, or distribute goods in Canada or abroad;

import goods produced abroad into Canada; or

control an entity engaged in these activities.

An “entity” is a corporation, trust, partnership, or other unincorporated organization that:

is listed on a stock exchange in Canada; or

has a place of business in Canada, does business in Canada or has assets in Canada, and satisfies at least two of the following in at least one of the two most recent financial years, based on its consolidated financial statements:

had at least $20 million in assets;

generated at least $40 million in revenue; or

employed an average of at least 250 employees.

Public Safety Canada has released guidance (the Guidance) about the application of the Act, which includes commentary in respect of several of these items. Companies should consider this commentary in determining whether the Act applies to them. For instance, although the Act does not prescribe a minimum threshold value of goods that an entity must produce, sell, distribute, or import in order for the Act to apply, the Guidance indicates that the Act should be read as excluding very minor dealings.

What needs to be reported under the Act?

Annual reports need to include the following information:

the steps taken to prevent and reduce the risk of forced or child labour in the entity’s production of goods or in the productions of goods imported into Canada by the entity;

the entity’s structure, activities and supply chains;

the entity’s policies and due diligence processes relating to forced and child labour;

the parts of the entity’s business and supply chains that carry a risk of forced or child labour;

measures taken to remediate forced or child labour and loss of income to the most vulnerable families resulting from measures taken to eliminate forced or child labour;

training provided to employees; and

how the entity assesses its effectiveness in ensuring that forced and child labour are not used in its businesses and supply chains.

What is the filing deadline?

Entities to which the Act applies are required to file a report with the Canadian Minister of Public Safety and Emergency Preparedness by May 31 of each year, beginning May 31, 2024, and to publish such report on a prominent place on their website. Such report will also be made available to the public through an online registry. Entities incorporated under the Canada Business Corporations Act, or any other Canadian federal legislation will also need to provide such report to their shareholders with their annual financial statements.

Entities who fail to comply with the provisions of the Act or who knowingly make a false or misleading statement may be subject to fines of up to CAD$250,000. The directors, officers, and agents of the offending entity could also be held personally liable if they ordered or authorized the infringement or consented to or participated in the same.

Other considerations?

In addition to the annual reporting requirement under the Act, the Guidance introduces a comprehensive online questionnaire (the Questionnaire) that reporting entities are required to complete as part of the process of submitting a report to the Minister of Public Safety. Failure to complete the Questionnaire is an offence under the Act, subject to the same penalties as failure to file a report.

The Questionnaire is designed to collect the information necessary to satisfy the requirements under the Act. Accordingly, the Questionnaire can be used as a guide to develop the entity’s annual report. The Guidance also confirms that there is no prescribed level of detail for Questionnaire responses or the report. Instead, entities should use discretion in determining the appropriate level of detail proportionate to their size and risk profile. However, information provided in the Questionnaire must be consistent with the information provided in an entity’s report.

Reports must be approved by the entity’s governing body and include an attestation (the required form of which is provided in the Guidance) signed by one or more members of the entity’s governing body, together with the approving member’s name and title, the date of signature and a statement that the approving member has the legal authority to bind the entity.

Reports must be in English and/or French and the Guidance provides they cannot exceed 10 pages in length (or 20 pages in length if the report is in both English and French) and must be submitted as a PDF file which does not exceed 100MB.

An entity may submit a joint report covering its own actions and those of any entities it controls. However, the Guidance provides that a joint report should only be submitted if the information provided applies generally to all entities covered by the report.

Next steps?

Given the scope of information that must be reported under the Act and the diligence and resources that may be required to gather such information, businesses within the scope of the Act should be gathering the information required to prepare and submit their initial report before the May 31st deadline.

2024: The Year of Small Cap Comeback? - Spotlight on TSX Venture Exchange

We begin with a look at what 2024 may hold for small-to-mid cap stocks from TMX Group, owners of the Toronto Stock Exchange and the TSX Venture Exchange. The authors, George Khalife (Chicago), Erik Andersen (Dallas), and Delilah Panio (Southern California) discuss how 2024 has the potential to be a landmark year for small-cap stocks and how the TSXV not only presents a viable option but also a unique pathway for growth and success to U.S. companies. As we venture further into 2024, let's watch closely as this exciting chapter in the financial markets unfolds, potentially reshaping the future of micro caps.

Authors: George Khalife (Chicago), Erik Andersen (Dallas), Delilah Panio (Southern California)

Heading into 2024, there's a growing sense of optimism in the financial sector, especially regarding small-to-mid cap stocks.

Interest rate hikes, a tool used to mitigate recession risks, have significantly influenced small-cap stocks, particularly in the aftermath of the 2021 capital markets surge. This shift is not only due to the Federal Reserve's strategy of maintaining higher rates but also because of a change in valuation perspectives. With rising interest rates, the discounted cash flows of these companies are viewed differently i.e. when interest rates rise, the cost of borrowing increases which translates to a higher cost of capital and therefore a higher discount rate, resulting in much lower valuations. This change in financial assessment has made these stocks less attractive to investors who are now more critical of balance sheets that don't showcase strong potential for growth.

Moreover, the market looks to have observed a pivotal shift in investor sentiment, transitioning from favoring growth to prioritizing value. Investors who might prefer larger companies with more stable cash flows and dividends, may re-allocate capital away from small-to-mid cap companies impacting their valuations. This shift places small caps in a challenging situation, as they must adapt to investor interests to secure capital. This adaptation is essential because, traditionally, small caps have been celebrated for their potential for robust earnings growth. However, under current market conditions, their ability to deliver this growth is questioned.

Richard de Chazal, a macro analyst at William Blair, aptly compares small caps to speedboats in the equity world. They are agile but highly sensitive to market changes, unlike larger, more stable 'supertanker' stocks.[1] This analogy highlights the current vulnerability of small caps in a rapidly changing economic environment, where investor priorities and the broader economic framework have shifted significantly since 2021.

Key to this sensitivity is small caps' reliance on capital markets for growth funding, often necessitating more frequent borrowing. This makes them first in line for less favorable borrowing conditions and more susceptible to interest rate fluctuations and economic cycles than larger-cap stocks.

At the recent Annual Economic Outlook hosted by the Executives’ Club of Chicago, John W. Rogers, Jr., Chairman and Co-CEO of Ariel Investments, shared his insights, suggesting that 2024 might be a landmark year for smaller and value stocks. These stocks had taken a back seat throughout most of 2023, overshadowed by the market rally led by the "Magnificent 7," which now command a market cap more than triple that of the Russell 2000.

Rogers drew parallels between the current market and the internet bubble era, noting, “We think it’s an extraordinary time for smaller and value stocks. It's reminiscent of the internet bubble period. When that bubble burst, it was a great period for small and value stocks as the larger market started to falter.”

He also highlighted the potential in small-cap companies beyond the Magnificent 7[2]. According to Rogers, these stocks are often "hidden gems," overlooked and undervalued in the current market landscape. Contrasting with Warren Buffet's general advice to invest in the S&P 500Ⓡ, Rogers emphasized the current opportunity in stocks that are "misunderstood, neglected, not well-followed, [and] not well-researched," describing them as "extraordinarily cheap" and ripe with investment potential.

Historical patterns indicate a potential shift in stock market dynamics, where small-cap stocks may take the lead, particularly in the event of an economic downturn. According to an article by Barrons which analyzed the trends from the last 11 recessions reveals an interesting pattern: small-cap stocks have historically outperformed large-cap stocks by approximately 16% in the year following the onset of a recession. Take, for instance, the era surrounding the dot-com bubble burst. Between 1995 and 2000, the S&P 500 consistently outperformed the Russell 2000, averaging an eight-percentage-point lead annually. However, the tables turned in the period from 2001 to 2004. During these years, the S&P 500 experienced a decline of about 2%, whereas the Russell 2000's value segment witnessed a remarkable surge of 80%.[3]

A research report dated January 16, 2024 by National Bank of Canada Financial Markets (NBCFM), anticipates a period of "catch-up" for small-to-mid cap stocks within their scope of analysis.4 The report observed that numerous small-to-mid cap companies have implemented strategies to improve their capital allocation, similar to their larger counterparts. However, these strategic moves have not yet been fully reflected in the valuations of many such companies. This discrepancy may present a unique opportunity in the market for these undervalued stocks.

TSX Venture Exchange: A Haven for Small-to-Medium Cap Companies

Amid these challenges, TSX Venture Exchange (TSXV), the junior market to Toronto Stock Exchange (TSX), stands out as a unique and tailored solution for small- and mid-cap companies. Increasingly, U.S. companies are looking to TSXV as a financing option. In the past five years, 55 U.S. companies listed on TSXV accessing public venture capital for their growth funding. And in the past two years, even under tough market conditions, notable U.S. companies such as Midwest Energy Emissions, Full Circle Lithium, The Fresh Factory, and Yerbae Brands listed on TSXV. Leveraging TSXV as an alternative to private capital options, in the past five years, TSXV U.S. companies raised CDN$7.8B through 490 financings, representing an average of CDN$15.9M, which is truly venture capital.

You can hear from the CEOs about their capital raising options and why they chose TSXV through the TMX Presents podcast.

TMX Presents: The Podcast with Highlighted U.S. Companies

Yerbae Brands Corp (TSXV:YERB.U) - LINK to Podcast Episode 030

Full Circle Lithium Corp (TSXV:FCLI) - LINK to Podcast Episode 033

Midwest Energy Emissions Corp (TSXV:MEEC) - LINK to Podcast Episode 031

Graduates from TSXV to TSX further exemplify TSXV’s efficacy as an incubator marketplace. Several U.S. companies graduated in the last five years, including Real Brokerage, Quipt Home Medical Corp, and Hamilton Thorne.

TSXV offers U.S. companies an alternative avenue to U.S. public capital and traditional private venture capital, with TSXV issuers raising, typically between $2mm-$25mm. This path, scarcely available in the United States, is bolstered by an ecosystem of retail and institutional investors, investment bankers, and analysts specifically attuned to small cap stocks. The cost savings, coupled with more significant employee incentive mechanisms, make TSXV an attractive option for the right U.S. company. Successful companies on TSXV have the opportunity to graduate to TSX and potentially cross-list on a major U.S. exchange.

In conclusion, 2024 has the potential to be a landmark year for small-cap stocks. TSXV emerges as a beacon of opportunity in this landscape, offering a unique pathway for growth and success to U.S. companies. For companies considering going public, the choice of market is crucial. TSXV not only presents a viable option but also a unique value proposition in the dynamic world of small-to-mid cap stocks. As we venture further into 2024, let's watch closely as this exciting chapter in the financial markets unfolds, potentially reshaping the future of micro caps.

Visit the U.S. Website to connect with your regional representative and for more information.

------

Copyright © 2024 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this article, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange, The Future is Yours to See., and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc. All other trademarks used in this article are the property of their respective owners.

This document may contain "forward-looking information" (as defined in applicable Canadian securities legislation) that is based on expectations, estimates and projections as of the date the content is published. Wherever possible, words such as "will" "ensure that" "anticipate", "believe", "expects" and similar expressions have been used to identify these forward-looking statements. Information in this document has been furnished for your information only, is accurate at the time of posting, and may be superseded by more current information. Except as required by law, we do not undertake any obligation to update the information, whether as a result of new information, future events or otherwise. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by the forward-looking information.

Unless otherwise specified, data sourced from TSX/TSXV Market Intelligence Group, as of December 31, 2023.

[1] “Markets Brief: Is It Finally Time to Buy Small-Cap Stocks?”, Morningstar, Inc., https://www.morningstar.com/markets/markets-brief-is-it-finally-time-buy-small-cap-stocks

[2] “Ariel Investments says ‘Magnificent 7’ stocks could underperform while neglected names rebound next year”, CNBC

https://www.cnbc.com/2023/12/12/top-investors-say-magnificent-7-stocks-could-underperform-while-neglected-names-rebound-next-year.html

[3] “Small-Cap Stocks Can Shine in a Recession”, Barrons. https://www.barrons.com/articles/small-cap-stocks-buy-recession-invest-b3377cae

4 “Technology Year Ahead 2024, Still More Upside”, NBCFM Thematic Research.

https://nbfm.ca/research

Our MAPLE Community in 2023

It is my pleasure to share some of the highlights of 2023 for our Canada-U.S. community. It was a privilege for our MAPLE team to engage with organizations across sectors and markets throughout the year many of whom we have since welcomed as new members. Networking and storytelling are the building blocks of MAPLE and events, both our own and partner programs, our MOMENTUM e-publication and our Conversations video series all played important parts in connecting people and ideas together.

As we now lean into a brand new year, our members are working in over 25 sectors and are based in over 25 markets across Canada and the United States supported by 5 chapters each led by an Executive Director.

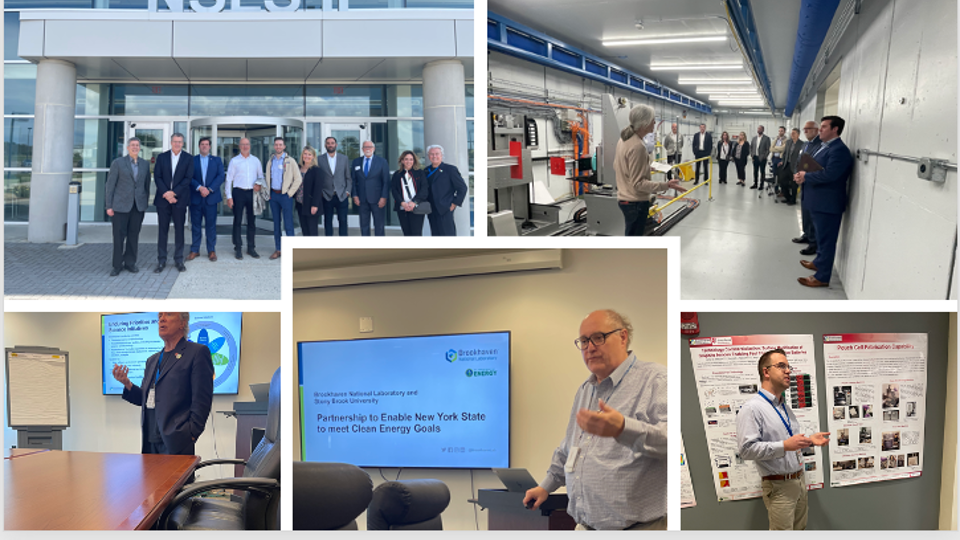

MAPLE-US Commercial Service in Canada SelectUSA Event at Microsoft Vancouver BC

Author: Stephen Armstrong, Co-founder

It is my pleasure to share some of the highlights of 2023 for our Canada-U.S. community. It was a privilege for our MAPLE team to engage with organizations across sectors and markets throughout the year many of whom we have since welcomed as new members. Networking and storytelling are the building blocks of MAPLE and events, both our own and partner programs, our MOMENTUM e-publication and our Conversations video series all played important parts in connecting people and ideas together.

As we now lean into a brand new year, our members are working in over 25 sectors and are based in over 25 markets across Canada and the United States supported by 5 chapters each led by an Executive Director. In addition to celebrating our 8th anniversary last June, we celebrated our 6th anniversary in British Columbia, 3rd in New York and our 1st anniversaries in Ontario and Colorado although our programming began in Ontario all the way back in 2016. I’d like to thank all our Chapter Executive Directors for the time and insights they give to our community connecting with regional partners and hosting memorable events.

MAPLE Southern California Spring Reception Los Angeles

Among some of the special programs MAPLE chapters hosted last year were:

An afternoon exploring how to scale to the US with expert speakers held at Microsoft’s Vancouver campus in collaboration with the US Commercial Service and US Consulate General in Vancouver.

Touring the world class scientific facilities and hearing from the leadership of the Advanced Energy Research and Technology Center at Stony Brook University and Brookhaven National Laboratory on Long Island, New York.

Connecting with the start-up community in Kitchener-Waterloo on the campus of Communitech with a panel discussion spanning talent, tax, and intellectual property when scaling your business to the US.

Bringing Canada’s game (and even a NHL alum or two) to World Trade Day in Denver as part of the MAPLE exhibit

Celebrating Southern California’s economic ties with Québec at the home of Québec Delegate General in California, David Brulotte, with economic insights from Investissement Québec

Touring the Vancouver port as guests of Global Container Terminals

A special moment was hearing from one of our corporate members whose presentation included how they have leveraged the MAPLE community to expand their business network and forge new partnerships and customers. Their MAPLE membership experience was shared in the spirit of encouraging other firms to recognize what is possible through their active membership too. Thank you!

MAPLE Colorado at World Trade Center Denver's World Trade Day

The stories that we had the privilege of sharing through our monthly e-publication MOMENTUM were very special and provided terrific insights into many markets and sectors.

Trade with a View: A profile of the international bridges that connect Ontario and the US from Natalie Kinloch, CEO of the Federal Bridge Corporation.

Celebrating Canada on the World Stage: The story of the largest Canada Day celebration outside of Canada held in Trafalgar Square in London, England as described by former Canadian Ambassador to the UAE and current Celebrate Canada Worldwide Chair, Marcy Grossman.

In Uncertain Times, Stronger Together: The origin story of ‘Fast in the 6’ – an annual interfaith celebration of Ramadan in Toronto that unites Canadians through a free public iftar meal from co-founder Dany Assaf.

The Latino GDP Project: An introduction to important economic research by the Center for Economic Research and Forecasting at California Lutheran University in Greater Los Angeles as described by its Executive Director, Matthew Fienup PhD.

Leveraging Generative Artificial Intelligence in Business: Operations and Risks was the focus of both an article and two episodes of our Conversations video series by several partners and attorneys at IP law firm, Knobbe Martens dialing us into the new world of AI.

The strength of the life sciences sector in Ontario was the focus of an article by Ontario Trade & Invest who later shared a broader look at what’s new and notable in the Province at our fall reception in Los Angeles and who connected with the Long Island business community at our recent New York reception.

MAPLE BC touring Global Container Terminals, Vancouver BC

We also had the pleasure of interviewing leaders who are guiding and shaping the tremendous relationship that Canada and the U.S. share. Our thanks to the those we had the pleasure of interviewing in 2023:

Québec Delegate General in Los Angeles David Brulotte (video)

Canadian Consul General in New York Tom Clark

Québec Delegate General in New York Martine Hébert who spoke beautifully of the longstanding ‘love story’ between New York State and Québec (video)

U.S. Ambassador to Canada David Cohen on the occasion of the 8th anniversary since founding MAPLE Business Council

These interviews along with the articles shared in 2023 are accessible on our Cross-Border Insights website as well as the content pages of our community website.

MAPLE New York tours Brookhaven National Laboratory

Our Conversations video series which we launched in 2019 now has more than 75 episodes. In 2023, we had the pleasure of speaking with Quebec's Delegate Generals in Los Angeles and New York, David Brulotte and Martine Hébert, as well as explore the topic of generative AI and content development for brands with IP law firm Knobbe Martens, and interview the Toronto-based founder of QA Consultants, Alex Rodov. Find our entire library of episodes on both of our websites including the Conversations pages of our community website. And we have already released our first two episodes of 2024 with Toronto-based immigration law firm, Greenberg Hameed PC.

MAPLE Conversation with Québec Delegate General in New York, Martine Hébert

A special thank you to our partners who shared their missions with us in 2023:

Early in 2023, we signed a MOU with Vancouver-based Latincouver, the cultural and business hub for the diverse 100k+ strong Latin communities in British Columbia. A special shout-out to founder Paola Murillo!

Panel collaborations with Kitchener-Waterloo-based Communitech Outposts in Toronto and Waterloo region sharing how Canadian companies’ hiring of US talent can be optimized (and easier than you may think) and one member's experience scaling to the US.

Start-up community insights from our friends and partner, The Alliance for Southern California Innovation, based in Pasadena, California.

Collaborating with the US Commercial Service in Canada and the US Consulate General offices in Vancouver, Calgary, and Toronto to co-host our annual "Select USA” event in Vancouver

The outstanding work of Canada’s Trade Commissioner teams at the Consulate General of Canada with whom we have the opportunity to collaborate in Southern California, Denver and New York.

As a community that is now in our 9th year, we also must bear witness to the challenges that life inevitably brings and we experienced the sudden loss of a dear friend and board member, Anna Innis of Air Canada. Anna’s legacy is of a joyous spirit that overcame borders of all kinds to bring people together and to make amazing things happen. We are grateful to have known her and her spirit of giving and fellowship will live on in the hearts and minds of everyone her counted her as a friend and colleague.

It’s not possible to sum up an entire year in just a few words, but we definitely left 2023 richer for the people we met, the ideas and expertise shared, and the knowledge that what Canada and the US share is incredibly important and vital and it will continue to grow and strengthen one conversation, one insight, and one handshake at a time.

Thank you for being part of our community in 2023 and we look forward to connecting with you in 2024.

Stephen Armstrong

Co-Founder

MAPLE Ontario panel discussion at Communitech campus Kitchener-Waterloo

H1-B Visa Headaches? Canada Emerges as an Attractive Alternative for Corporate Immigration

The H-1B visa program, designed to bring highly skilled foreign workers to the US, has become increasingly complex and competitive. With annual visa caps and lengthy processing times, many companies struggle to secure H-1B visas for their talented employees. As a result, many companies are turning to Canada, a country with a strong tech talent pool and a more streamlined immigration process.

In this article, I will discuss the problems with the H-1B program and why Canada has become such an attractive option for corporate immigration. We will also discuss how companies can leverage the expertise of a Professional Employer Organization (PEO) to skip lengthy immigration processes, relocate their foreign staff to Canada, or hire remote employees in Canada, whether they have a Canadian office or not.

Author: Marc Pavlopoulos, founder/CEO, Syndesus

The H-1B visa program, designed to bring highly skilled foreign workers to the US, has become increasingly complex and competitive. With annual visa caps and lengthy processing times, many companies struggle to secure H-1B visas for their talented employees. As a result, many companies are turning to Canada, a country with a strong tech talent pool and a more streamlined immigration process.

In this article, I will discuss the problems with the H-1B program and why Canada has become such an attractive option for corporate immigration. We will also discuss how companies can leverage the expertise of a Professional Employer Organization (PEO) to skip lengthy immigration processes, relocate their foreign staff to Canada, or hire remote employees in Canada, whether they have a Canadian office or not.

Let’s jump in.

The H-1B visa has become more challenging, here’s why

The H-1B visa program poses several challenges for businesses hiring foreign employees. Each year, there is a cap on the number of visas that can be issued, and the demand for H-1B visas typically exceeds the supply. Due to the limited number of visas available — currently capped at 85,000 — inevitably, some won’t be selected, and companies may feel out of options. A lottery system randomly selects individuals to determine who can apply for the visa, which adds uncertainty to the process.

On top of this, there is a significant green card backlog to contend with and long processing times, making it difficult for companies to hire critical talent on time. With the situation as it is, it’s no surprise that employers are exploring alternative solutions, and Canada is coming out top.

Canada is an attractive alternative for corporate immigration

Canada stands out in the race to attract global tech talent, offering many advantages for foreign companies seeking to hire or retain talent. This includes a lower cost of doing business overall, possible tax breaks, and a streamlined immigration process that is more predictable than the US system. Canada’s world-class immigration program, the Global Talent Stream (GTS) — part of the Global Skills Strategy — is a great option for Canadian and foreign businesses who want to hire foreign talent. Employers can speed up the process of hiring foreign workers to fill specialized jobs in a matter of weeks.

GTS is currently one of the world’s fastest immigration pathways for skilled workers and offers a fast-track pathway to residency in Canada. Employees can obtain a Canadian work visa, relocate, and quickly start working; furthermore, Canadian permanent residence can be possible in one to two years, and citizenship can be acquired in around five years. Once the employee has permanent residence status, they can get most social benefits Canadian citizens receive, a more affordable cost of living, accessible healthcare, and markedly more reasonably priced education.

It’s no surprise that Canada is a desirable option for immigrants, especially when compared to the uncertainty of life on a work visa in the US. Employees can even move back to the US in the future, with new experience gained while working in Canada — opening up new immigration pathways to the US. If the employee becomes a Canadian citizen, business travel becomes significantly easier as Canadian citizens don’t require visa stamps from a consulate abroad. It would also benefit them when reapplying for a Green Card (US permanent residency) because they wouldn't have to wait as long as when they were applying from countries such as India or China, which have a greater backlog.

Should you open a Canadian office?

Not necessarily, but for companies that are looking for a more permanent presence in Canada, opening an office can provide several advantages. It can allow the company to build a closer relationship with Canadian employees and customers and facilitate hiring additional Canadian talent. Canadian offices owned by US-based companies are more than legal entities on foreign soil; they can function as strategic hubs for global talent acquisition.

When opening an office in Canada, companies can either handle all employment-related matters themselves or engage the services of a Canadian PEO. One of the simplest solutions for US companies looking to scale up and navigate the complexities of managing Canadian operations is to work with a PEO or an Employer of Record (EOR) that understands Canadian tax laws.

PEOs and EORs streamline hiring in Canada

These organizations provide a simple way for US companies to hire tech talent in Canada. They act as the legal employer for the worker, handling all aspects of payroll, taxes, and HR compliance. This can significantly reduce the administrative burden for foreign companies, allowing them to focus on their core business activities. By working with a third-party employment service, companies can hire abroad even if they don’t have an office in that country, offering an easier way for companies to take advantage of a global talent pool.

Working with a Canadian PEO is a viable option for businesses that are not ready to open a physical office in Canada. The PEO acts as a co-employer and handles all employment-related matters for the worker, including onboarding, payroll, benefits, and termination. This allows the US company to maintain control of the worker's work and direction while the PEO takes care of the administrative details.

An EOR acts as an employee’s legal employer and provides all the HR, legal, tax, payroll, and immigration services needed for remote hiring to enable companies to hire workers remotely in a country where they don’t have an office. So, US employers who want to hire a remote tech worker in Canada don’t need expertise in Canadian immigration or employment law, nor do they need to hire attorneys, accountants, and other professionals.

In both cases, the foreign company hires and retains key talent in Canada, avoiding the difficult H-1B visa process altogether, and has easy access to that employee when needed. Employees can continue working for their employer and retain a US salary while reaping the benefits of life in Canada. US companies can get value both in the short term, given the quick timeline of the GTS compared to the H-1B process, and in the long term, given Canada's quick route to permanent residency and eventual citizenship.

The GTS offers creative and forward-thinking ways to keep skilled and much-needed employees. Don’t sleep on Canada.

Syndesus helps companies leverage Canada’s tech talent and favorable immigration laws with turnkey PEO and EOR services. Reach out to us to learn more.

Marc Pavlopoulos, founder/CEO Syndesus

The Challenge of Taxing Digital Services

The digital economy has presented complex challenges in the allocation of taxation rights between countries. Large multinational corporations, without establishing a physical presence or tax base in Canada, have been generating substantial revenues through digital services within the country. These activities include selling digital services, collecting and monetizing user data, providing social media services and delivering digital advertisements to Canadian users. Under the current multilateral tax frameworks, these digital service revenues remain largely exempt from taxation in Canada unless allocated to a physical presence. This challenge is compounded by the exponential growth of the digital economy, which now accounts for nearly 20% of the global economy.

Authors: Daniel Mahne, Senior Manager; Olukayode Akinbosede, a Senior Associate, RSM Canada

Introduction: The challenge of taxing digital services

The digital economy has presented complex challenges in the allocation of taxation rights between countries. Large multinational corporations, without establishing a physical presence or tax base in Canada, have been generating substantial revenues through digital services within the country. These activities include selling digital services, collecting and monetizing user data, providing social media services and delivering digital advertisements to Canadian users. Under the current multilateral tax frameworks, these digital service revenues remain largely exempt from taxation in Canada unless allocated to a physical presence. This challenge is compounded by the exponential growth of the digital economy, which now accounts for nearly 20% of the global economy.

The future of digital taxation in Canada: A comparative analysis

The Digital Services Tax Act (DSTA): A Stop-Gap Solution

The DSTA, slated to take effect on or after Jan. 1st, 2024, introduces a new tax regime for the taxation of digital services within Canada. It is a unilateral measure designed to address two critical issues:

1. Taxation of revenues generated by large corporations from digital services within Canada.

2. The absence of a multilateral instrument to effectively regulate the taxation of digital services revenue across multiple jurisdictions.

The DSTA will impose a three percent tax on in-scope revenues exceeding $20 million in a calendar year, generated by corporations with global annual revenues surpassing €750 million. The DSTA's application will be retroactive to Jan. 1, 2022, for corporations meeting the specified threshold.

The OECD's Pillar One: An evolving multilateral solution

The Organization for Economic Cooperation and Development (OECD) proposed an initiative under the Base Erosion and Profit Shifting (BEPS) project, known as Pillar One, which aims to address the taxation of digital services. The current draft of Pillar One is composed of two primary elements: "Amount A" and "Amount B", having since dropped an originally proposed “Amount C”.

Amount A: Under Pillar One, a market jurisdiction–determined by sourcing rules such as where customers and users are located–gains the authority to tax the income of foreign multinational corporations even in the absence of a physical presence. Adjusted global profits before tax are calculated and utilized to reallocate a portion of profits to the respective market jurisdiction for taxation. Multinational corporations with global revenues of €20 billion or more and profits exceeding 10% fall within the scope of Pillar One Amount A’s application. The amount of an MNEs global profits subject to reallocation to a market jurisdiction is 25% of the total profit amounts exceeding the 10 profit threshold.

The proposals also include a marketing and distribution profits safe harbor mechanism to avoid conflicts with existing profit allocation rules and prevent double taxation.

Amount B: This element simplifies transfer pricing rules for marketing and distribution activities by standardizing pricing and streamlining the process. The final framework for Amount B, encompassing scope, pricing methodology, documentation requirements, and tax certainty considerations, is still under development by the OECD.

Comparing DSTA and Pillar One Framework

While both the DSTA and Pillar One address the taxation of revenues from digital services in Canada, they differ significantly in two key aspects.

Thresholds: The DSTA applies to corporations with global revenues above Euro 750 million, whereas Pillar One sets a substantially higher threshold of Euro 20 billion. This variation in thresholds significantly impacts the potential tax base.

Taxable Base: Pillar One reallocates profits exceeding 10 percent across market jurisdictions, with only the profit amount above this threshold subject to reallocation. In contrast, the DSTA imposes a 3% tax on revenues exceeding $20 million CAD, representing a tax on gross revenues rather than net profits.

The decision ahead: DSTA and the future of Pillar One

The OECD has released the multilateral convention (MLC) to implement Amount A of Pillar One on Oct. 18, 2023. The crucial question arising from recent developments is whether Canada will sign onto the multilateral Pillar One framework as presently constituted and repeal the DSTA, which is designed as a proxy to Pillar One. The decision hinges on several factors:

1. Amount B's significance: Amount B's finalization is crucial for efficient tax base determination under Pillar One. Without clear guidance on related party transaction valuation, MNEs may exploit existing transfer pricing rules and reduce taxable profits under Pillar One or evade its application entirely.

2. Revenue projection: The DSTA's projected revenue may surpass that of the Pillar One Framework, mainly due to lower thresholds (i.e., DSTA scope test being purely revenue-based vs. Amount A scope test being partly profit-based).

3. Negotiation complexity: Negotiating and finalizing multilateral agreements for Pillar One is expected to be a protracted process, unlikely to conclude within 12 weeks.

4. Ratification process: Once Canada agrees to the Pillar One framework, the DSTA must be repealed. The details of the MLC will need to be reviewed and approved by the Canadian government. In addition to these steps, new domestic legislation will be required to implement the Pillar One framework into domestic law or applicable existing tax legislation (i.e., the Income Tax Act), will need to be amended.

Conclusion

In conclusion, while both the DSTA and Pillar One aim to address the taxation of digital services in Canada, the differences in thresholds, taxable base and negotiation timelines may lead to the DSTA remaining in effect for the foreseeable future. The decision to sign onto the multilateral framework and repeal the DSTA hinges on several complex factors, and a definitive resolution is not expected in the near term. The DSTA serves as a practical stop-gap solution until the multilateral framework becomes operational.

For more information on RSM, please visit us in Canada at https://rsmcanada.com/ and in the United States at https://rsmus.com/

Daniel Mahne, Senior Manager; Olukayode Akinbosede, a Senior Associate, RSM Canada

Doing Global Business in These Times

Doing business cross border has significantly changed due to the pandemic. This article looks at changes in doing global business in recent years from a practitioner's perspective, specific trends and factors that impact successful brand entry into a new country and how several countries where you might take your business are expected to do economically in 2024. Data referenced in this article is sourced from the EGS Global Business Bi-Weekly Newsletter, monitoring over 40 online information sources, visiting many of the countries listed post-pandemic and input from the EGS network of in-country associates who live and work in their economies.

Author: Bill Edwards, CEO and Global Advisor, Edwards Global Services, Inc. (EGS)

Doing business cross border has significantly changed due to the pandemic. This article looks at changes in doing global business in recent years from a practitioner's perspective, specific trends and factors that impact successful brand entry into a new country and how several countries where you might take your business are expected to do economically in 2024. Data referenced in this article is sourced from the EGS Global Business Bi-Weekly Newsletter, monitoring over 40 online information sources, visiting many of the countries listed post-pandemic and input from the EGS network of in-country associates who live and work in their economies.

The pandemic kept us from visiting other countries and face-to- face establishing or building business relationships as we were limited to phone calls, emails and zoom meetings. As Terri Morrison summarizes in her landmark book on doing business in 60 countries, “Kiss, Bow, or Shake Hands”, much of the world does business based on establishing relationships which I have found to be true over four plus decades of doing business on six continents. This means face-to-face relationship building is required to secure new business in other countries. Well, travel is back, and your competitors are traveling to do business! But beware, business travel to the Americas, Asia Pacific, Europe and the Middle and Near East has become considerably more expensive since the pandemic.

What has changed and what is the picture for doing cross border business in 2024? Below are some factors to keep in mind when planning your 2024 new country marketing budget. And while there is war and unrest in parts of eastern Europe and the Middle East, interest rates are high and inflation remains a concern, there are several countries where the GDP growth will be high in 2024, where governments are increasingly business friendly and local businesses are making new investments. Several factors will impact the ability to do cross border business in 2024.

According to the London magazine, the ‘Economist’, there will be “more than 70 elections in 2024 in countries that are home to around 4.2 billion people.” Elections bring uncertainty as to what business policies the winner will try to put into place.

Interest rates directly impact the ability of companies in countries to fund new investments and are expected to stay at multi-year year highs during 2024. Higher interest rates in a country tend to dampen new investment.

The International Monetary Fund (IMF) projects 2024 annual GDP growth in OECD countries at 2.2%, in developing countries at 4.6% and world GDP growth at 3.0 as of their October 2023 report. The IMF expects greater variation in growth rates among OECD countries, with some countries experiencing strong growth and others experiencing weak growth. GDP growth rate provides a broad measure of economic activity and can be a useful tool for analyzing the investment climate in a country. Generally, the higher the GDP annual growth rate, the more new investment is likely to happen in a country in a year. The more new investment, the better the business climate for international brands trying to enter a country and do business.

And then there is inflation which continues to drop in most countries. According to the International Monetary Fund (IMF) in their October 2023 report inflation in OECD countries is expected to decline from 7.0% in 2023 to 5.2% in 2024, while inflation in developing countries will average 5.4% in 2024, down from an estimated 6.7% in 2023. The U.S. is expected to see 2.5% and Canada 2.4% inflation.

Considering the above factors, there are some interesting countries to consider for doing business in 2024. For each of the countries below, the IMF projected GDP growth percentage for 2024 is shown.

Americas

Brazil – 3.1% - Although the country recently elected a left leaning President, he and his party are pushing for new laws that would greatly reduce the extremely cumbersome regulations for trying to do business in the country. If this happens it could especially help foreign companies trying to penetrate this large consumer market. Plus, the unemployment rate is relatively low, supporting consumer spending.

Chile – 2.5% - This country has a free-trade agreement with over 60 countries, giving foreign businesses access to a large consumer market. Recent political turmoil may be lessening, and the middle class is growing rapidly. This has been a good market for foreign brands for some years. Prior to recent political turmoil, Chile was known as the European level country tacked on to the side of South America.

Mexico – 2.3% - Nearshoring of foreign companies wishing to sell into Canada and the U.S. is accelerating. This includes Chinese companies who are making massive investments especially in the area around Monterrey and taking advantage of lower wages and more space available to build factories. The upcoming election and change of President will have business policy implications. Meanwhile, the Mexican peso has appreciated against the US dollar, making imports cheaper and boosting purchasing power.

Asia Pacific

China – 5.2%? – As mentioned above, companies are expected to continue to move manufacturing and sales to countries other than China in 2024 due to rising salaries and more restrictive Chinese Communist Party policies related to private businesses, both local and foreign. Few new foreign entrants are expected as mainland China investors are currently reluctant to take on new projects until they feel the government is on the side of businesses.

Indonesia – 5.3% - This country has a population of 280 million with a fast-growing tech savvy middle class over 52 million. A pending election could change a pro-business attitude in this natural resource rich country. This growth is driven by strong domestic demand, rising commodity prices, and government investments in infrastructure and human capital.

Japan – 1.6% - Major corporations for the first time in decades are looking to diversify into new industries. This brings new opportunities for foreign companies seeking to enter this normally mature market. Although its population is old and declining, the country has a large and growing middle class. And there is a growing awareness and acceptance of non-salaried career paths, including entrepreneurship, among young professionals. Consumer spending is expected to remain strong, supported by a huge rebound in tourism.

Philippines – 5.6% - With one of the fastest growing economies in Asia, Manila is a city with lots of cranes indicating strong government and private infrastructure investment. This Asian market is very open to U.S. brands and is the regional headquarters of many foreign companies. Growing disposable income and a young population mean increased demand for consumer goods and services. However, the country is becoming increasingly competitive, meaning foreign companies must compete on a higher level than in the past.

Europe and United Kingdom

Poland – 3.0% - Coming out of an election that returns a center leaning government to power, the large population is expecting a high GDP growth rate but with higher than EU average inflation. To encourage new investment the government has put in place tax breaks and investment incentives. One area seeing immense change and investment is the health care system that has not fully made the upgrade from communist times.

Spain – 1.8% - This GDP growth rate exceeds the European Union (EU) average in a strong employment market. The market is very open to foreign brands and to doing business cross border. Regulations and tax rates are more pro-business than most EU countries. A concern is that there are growing labor shortages in some sectors and commercial property is becoming harder to find and more costly.

United Kingdom – 1.4% - While the growing tech sector is a big plus in the United Kingdom, there are labor shortages due to Brexit and an election is looming that might bring a less than pro-business Labor party into power. Inflation and energy prices are higher than most EU countries.

The Middle and Near East

India – 6.1% - With the highest expected percent GDP growth in 2024 of a major market, this very diverse consumer market will be even more important to consider for 2024. They seem to need just about anything related to growth. But foreign companies doing business here will continue to find bureaucratic and cultural barriers to entry and success.

Saudi Arabia – 3.4% - This is one of the fastest growing markets in the world. The government is aggressively diversifying their economy away from oil & gas production and has put into place policies and cultural changes to make this happen. Foreign brands are even more accepted than in the past. Consumer spending is high. Even tourism is opening. The old difficult and time-consuming visa procedures have been replaced with a simple online e-visa.

Bottom Line: Despite several challenges there remain many places to successfully expand your business into in 2024 from Canada and the U.S. But it is essential to consider the factors highlighted in this article and to do your market research first. Traveling to a country and doing research by walking around remains an excellent way to truly understand the market for your products or services in another country.

William (Bill) Edwards is a global advisor to CEOs on taking their businesses global successfully. Download his quarterly GlobalVue 40 country ranking chart at https://edwardsglobal.com/globalvue. Contact Bill at +1-949-375-1896 or bedwards@edwardsglobal.com.

Mastering the Art of Fundraising: Insights from Experts in Santa Barbara's Startup Ecosystem

We are pleased to share some of the key takeaways from a recent "Fundraising in Today's Market" event in Santa Barbara, California organized by our partner, Pasadena-based Alliance for SoCal Innovation. This event series aims to help founders become more adept at securing the capital they need. A panel of local experts answered questions from the Santa Barbara startup community. Thank you to Eric Eide, Managing Director of the Alliance for SoCal Innovation, for sharing some of the top pieces of advice and summarizing some of the key themes discussed.

Fundraising in Today’s Market Event, Santa Barbara, CA - October 10, 2023

Author: Eric Eide, Managing Director, Alliance for SoCal Innovation

In the thrilling world of startups, there are three kinds of founders: good founders who are good fundraisers, bad founders who are good fundraisers, and good founders who are bad fundraisers. Only the first two categories get their dreams funded. These words of wisdom come from Woody Sears, the CEO and Founder of Autio, a recently funded consumer startup, who participated in a captivating panel discussion on startup investing at a recent founder-centric event hosted by the Alliance in Santa Barbara. The takeaway is clear – founders need to be exceptional at fundraising!

The Alliance for SoCal Innovation understands the importance of fundraising for startups. That’s precisely why we organize the “Fundraising in Today’s Market” event series, aimed at helping founders become more adept at securing the capital they need to grow their businesses. To deliver these valuable insights, we turn to local experts, and on October 10th, Santa Barbara’s SB Biergarten played host to a panel of Santa Barbara investors, including Julie Henley McNamara, Managing Partner at Entrada Ventures, and Mike Tucker, Partner at ScOp Venture Capital, who joined Woody Sears from Autio, on the panel. The event was skillfully moderated by Mark diTargiani, SVP at Pacific Western Bank, and it was a resounding success with 45 enthusiastic attendees from the Santa Barbara startup community. Special thanks to Gavin Block at Countsy for supporting this event and enabling attendees to build relationships over food and drinks.

Let’s delve into some key themes and advice shared during this enlightening panel:

Building a Strong Community: The Santa Barbara community was highlighted as being exceptionally supportive and tight-knit, providing an excellent environment for startups to thrive.

The Art of Fundraising: Raising money is an essential but challenging task that requires founders to not only understand the game but also actively network with other founders and funders. Viewing every interaction as an opportunity to learn and ask questions, even in the face of rejection, is invaluable.

Targeted Fundraising: To raise funds successfully, founders should target investors based on their company stage, possess a clear message about problem-solving and differentiation, and demonstrate traction through metrics.

Founder Evaluation: Chemistry and alignment are essential factors when determining a potential long-term founder-investor partnership. Authenticity is highly valued, and investors appreciate honest reporting of metrics, even when they are less than ideal. Due diligence plays a vital role in testing the trust that has been established before entering into a long-term financial relationship.

Advice, Insights, and Wisdom from the Experts:

Julie Henley McNamara, Managing Partner at Entrada Ventures:

Be authentic and honest during investor meetings.

Focus on building a healthy business rather than being overly concerned with valuation.

Foster dialogue and understanding between men and women in the startup ecosystem, which hopefully will lead to a more inclusive community.

Guide the conversation during investor meetings to ensure key information is conveyed.

Ask investors about the next steps and understand the “homework” founders must do to progress to the next step.

Mike Tucker, Partner at ScOp Venture Capital

Encourage founders to raise capital at a fair valuation, considering long-term implications.

Preserve cash and reduce burn to navigate market uncertainties.

Focus on building a great business and don’t stress too much about capital.

Seek out the right type of investor for your business and plan funding milestones accordingly.

Woody Sears, Founder & CEO of Autio

Speak with founders who have worked with potential investors to gain insights into their experiences.

Founders need to also be sure to do their due diligence on investors by speaking with portfolio companies.

Additional Nuggets of Wisdom for Founders:

Network and build relationships with angel investors who may provide early-stage funding.

Consider the differences in funding expectations and requirements for hardware vs. software startups.

Be mindful of market forces and adjust fundraising strategies accordingly, while focusing on fundamentals.

Attend upcoming events, both online and in-person, to connect with investors and industry professionals.

Seek warm introductions to investors to increase the chances of a positive response.

Apply to the SoCal Venture Pipeline program for assistance with warm introductions to investors.

The Alliance’s SoCal Venture Pipeline (SVP) powered by Pacific Western Bank connects founders with funders, resulting in raises, growth, and quality job creation. The selective program has supported 65 startups with individual investor introductions; 15 of these startups raised an impressive $63 million in investments thus far. Congratulations to Woody Sears and the Autio team for being one of the SVP companies that secured an investment round. The SVP program would not be a free resource to founders without the support of program sponsors Pacific Western Bank, WSGR, and KPPB, who are all committed to assisting SoCal founders in their journey to success.

In the fast-paced world of startups, it’s clear that mastering the art of fundraising is a non-negotiable skill. With the guidance and wisdom shared by these industry experts, founders in the Santa Barbara community and beyond are better equipped to navigate the complex world of fundraising and turn their entrepreneurial dreams into reality. The journey is challenging, but with the right mindset, support, and strategic approach, the sky’s the limit for these ambitious founders.

Eric Eide, Managing Director, The Alliance for SoCal Innovation

Fundraising in Today’s Market Event, Santa Barbara, CA - October 10, 2023

Four Key Questions to Ask Your Group Benefits Broker for a Successful Plan

This month we tap into the expertise of Toronto-based Sterling Capital Brokers, one of the leading independent benefits consulting firms in Canada. Andrew Blanchard, Sterling’s CEO, shares some key insights about group benefits planning. In today's dynamic economic climate, finding the right balance between providing valuable benefits to employees and controlling costs is essential. It is therefore key for organizations to design their entire benefits program so that it provides value and meets the objectives of the enterprise.

Author: Andrew Blanchard, Chief Executive Officer, Sterling Capital Brokers

Navigating the changing world of employee benefits and selecting the best group benefits plan for your organization can be a challenge. In today's dynamic economic climate, marked by unprecedented challenges and shifting priorities, finding the right balance between providing valuable benefits to employees and controlling costs is essential. To navigate this complex landscape successfully, it's essential for organizations to partner with brokers who not only understand their unique needs but also have the expertise to optimize the entire benefits program. To navigate this complex landscape, here are the four key questions to ask your broker about your benefits plan, addressing crucial aspects such as; plan design, the Total Loss Ratio (TLR), ease of administration, and rate lock strategies. These questions will help you make well-informed choices that can result in affordable yet employee-focused benefits solutions.

1. Plan Design: Aligning with Organizational Values