The Latino GDP Project

Author: Matthew Fienup PhD, Executive Director, Center for Economic Research & Forecasting, California Lutheran University, Westlake Village, CA.

Latino Gross Domestic Product (GDP)

The Latino GDP Project seeks to provide a factual view of the large and rapidly growing economic contribution of Latinos living in the United States. Gross Domestic Product (GDP) is a broad measure of economic activity, representing the value of all finished goods and services produced within a geographic area in a given year. GDP growth is a nearly universal summary statistic for the performance of an economy.

We estimate the U.S. Latino GDP by first making Latino-specific calculations of major GDP components decomposed across more than 70 expenditure categories. This is a detailed, bottom-up construction of the total economic impact of Latinos, one that leverages publicly available data from major U.S. agencies, including the Bureau of Economic Analysis (BEA), Bureau of Census, and Bureau of Labor Statistics. At the time of writing, the most recent year for which the core data was available is 2020.Thus, this research provides a snapshot of the total economic contribution of U.S. Latinos in that year.

As a summary statistic for the economic performance of Latinos, the 2020 U.S. Latino GDP[1] is extraordinary. The total economic output (or GDP) of Latinos in the United States was $2.8 trillion in 2020, up from $2.1 trillion in 2015, and $1.7 trillion in 2010. If Latinos living in the United States were an independent country, the U.S. Latino GDP would be the fifth largest GDP in the world, larger even than the GDPs of the United Kingdom, India or France.

While impressive for its size, the U.S. Latino GDP is most noteworthy for its rapid growth. From 2010 to 2020, the U.S. Latino GDP was the third fastest growing among the 10 largest GDPs, while the broader U.S. economy ranked fifth. Over that entire period, the growth of U.S. Latino GDP was 2.6 times that of Non-Latino GDP.

According to the dominant narrative, Latinos as a demographic cohort should have been knocked down by the COVID-19 Pandemic. Examining the impacts of COVID-19 on Latinos through the lens of the Latino GDP reveals a very different story. In 2020, in the face of the pandemic, the strength of the U.S. Latinos was sufficient for the U.S. Latino GDP to jump three spots, beginning the pandemic as the eighth largest GDP and finishing 2020 as the fifth largest.

The performance of Latinos during the pandemic is exemplified by income data. From 2010 to 2020, Latinos enjoyed significantly higher wage and salary income growth than Non-Latinos. During those years, Latino real income grew an average of 4.3 percent per year compared to only 2.1 percent for Non-Latinos. 2020 was exceptional. Despite the extraordinary challenges presented by the pandemic, Latino real wage and salary income surged 6.7 percent. Meanwhile, Non-Latino income shrank by 1.1 percent.

Latino incomes surged due to Latinos’ tremendous work ethic during the pandemic. In 2019, prior to the onset of COVID-19, Latino labor force participation (LFP) was a record 6.1 percentage points higher than Non-Latino. By April 2020, with the onset of government-mandated shutdowns, both Latino and Non-Latino LFP saw sharp declines. Yet, it was evident from the earliest months of the pandemic that Latinos would press through each subsequent wave of disease transmission and the re-imposition of lockdowns. In each case, they returned to work with urgency. In 2020, the Latino labor force participation rate premium hit a new all-time high, when U.S. Latinos were 6.5 percentage points more likely than their Non-Latino counterparts to be actively working or seeking work.

As a result of the hard work and persistence of Latinos, Latino economic performance during the pandemic year of 2020 was strong by any comparison. In 2020, Latino real GDP did contract, however the contraction was small. Real U.S. Latino GDP contracted by 0.8 percent compared to a 4.4 contraction for Non-Latino GDP. India’s GDP contracted by 7.1 percent. France’s contracted by 8.2 percent, and the United Kingdom’s contracted by an astonishing 9.8 percent. Among the largest countries on the world stage, only China experienced stronger growth than the U.S. Latino GDP.

None of this is to make light of the hardship that Latinos endured during the pandemic. Because of a historic lack of investment in health infrastructure for Latino communities, because of their strong work ethic and unique family structure, Latinos were among the groups hardest-hit by COVID-19. This occurred despite Latinos’ superior health outcomes which prevailed in the decade prior to the pandemic. Coming out of nowhere, COVID-19 very suddenly became the number one cause of death for Latinos as opposed to only the number 3 cause of death nationally. Yet, we find that the economic data published in this report honor the sacrifices made by Latinos and illustrate just how remarkable Latino strength and resilience really is. It also highlights just how much the broader U.S. economy benefited from that strength during the pandemic. Latinos were a critical source of resilience, not just for their own families and communities, but for the U.S. economy as a whole.

Economic Drivers of the Latino GDP

Year in and year out, pandemic or not, the economic output of Latinos in the United States grows more rapidly than the Nation’s economy as a whole. The growth premium that Latinos enjoy has proved enduring, and there are a number of factors driving this impressive performance.

Educational attainment

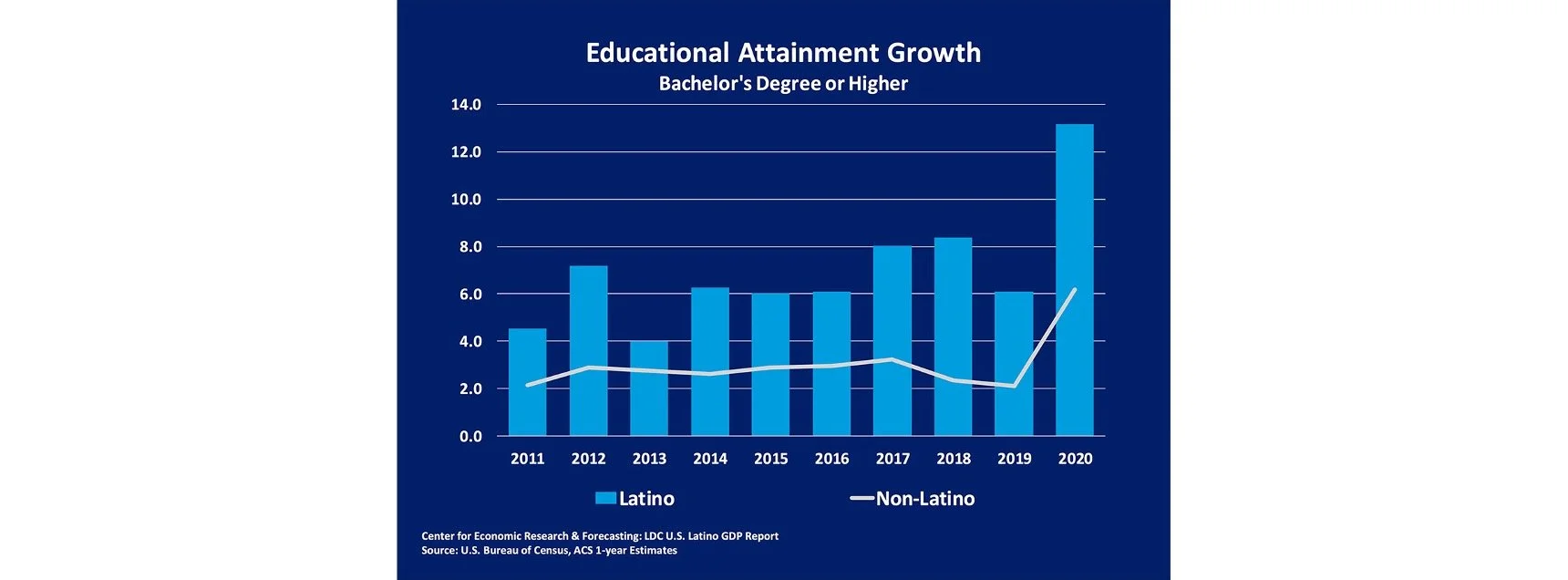

One of the most important drivers of rapid Latino income growth has been the significant accumulation of human capital by Latinos. One representation of this is the extraordinary growth of Latino Educational Attainment.

From 2010 to 2020, the number of people with a bachelor’s degree or higher education grew 2.8 times more rapidly for Latinos than Non-Latinos. The number of educated Latinos rose by 96 percent during this time, while the number of educated Non-Latinos rose by only 34 percent.

Population & Labor Force Growth

As we have documented in each of the past Latino GDP reports, Latinos continue to make strong and consistent contributions to the nation’s population and labor force. Perhaps more than any others, these two demographic trends amplify the economic impact of Latinos and reinforce the importance of Latino GDP growth to the continued growth of the U.S. economy and the prosperity that it produces.

From 2010 to 2020, the Latino population grew 21.9 percent, compared to only 4.3 percent for Non-Latinos. That is, Latino population growth was more than 5 times stronger. Despite being only 18.7 percent of the U.S. population, Latinos are responsible for more than half of U.S. population growth between 2010 and 2020.

Latino additions to the U.S. labor force are even more impressive. Latinos contributed an average of more than 600 thousand workers per year to the U.S. labor force over the entire period from 2010 to 2020. Non-Latinos contributed an average of only 225 thousand. Despite being only 18.7 percent of the U.S. population, Latinos are responsible for 73 percent of the growth of the U.S. labor force since 2010.

One factor which drives Latinos’ strong contribution to the U.S. labor force is that Latinos have a younger age distribution. In 2020, the Median Age for Latinos was 30.2 years. For non-Latinos, it was 40.8 years. Due to their relative youthfulness, Latinos are adding substantial numbers of people to the critical category of working age adults, defined as ages 16 to 64. Meanwhile, Non-Latinos are experiencing a high concentration of population in the 55 and older age range, representing large numbers of retirees and near-retirees. According to the Census Bureau by 2060, Latinos are projected to add over 30 million people to the working age population.

In the United States, Latinos coming of age and entering the labor force are overwhelmingly second- and third-generation Americans. These children and grandchildren of immigrants are combining the extraordinary and selfless work ethic of their elders with rapid educational attainment to propel not just Latino GDP but overall GDP growth in the nation.

Latino contributions to the working age population are even more important now that the country is experiencing the tremendous shortage of workers known widely as the Great Resignation. The dangerous shortage of workers that we predicted in previous reports seems to have arrived early and with greater intensity, as the pandemic drove early retirement among some workers and also pushed many non-retirement age adults to the sidelines of productive economic activity.

In addition to adding large numbers to the population of working age adults, working age Latinos are also significantly more likely to be actively working or seeking work than their non-Latino counterparts. In 2010, Latinos were 4.5 percentage points more likely to be working than Non-Latinos. This Labor Force Participation premium grew every year from 2010 to 2020. In 2020, Latinos were 6.5 percentage points more likely to be actively working, an all-time high for the Latino labor force participation premium.

On top of these dynamics, there are a number of demographic trends which represent a force multiplier for the impressive growth of Latinos’ economic impact.

Household Formation & Home Ownership

One example of a strong Latino demographic trend can be found in household formation. The number of Latino households grew 29.2 percent from 2010 to 2020, while Non-Latino households grew only 5.8 percent. That is, Latino household growth was five times faster. Despite being only 18.7 percent of the U.S. population, Latinos are responsible for 40 percent of the increase in U.S. households since 2010. With an average household size that is 42 percent larger (3.57 people per household for Latinos, compared to 2.50 for Non-Latinos), each new Latino household provides an outsized economic impact.

High rates of Latino household formation are no accident, stemming from both a younger age distribution and from the importance of the family in Latino society. A healthy rate of household formation is vital to economic growth, as new households increase current and future economic activity. Strong Latino household formation is a gift to the U.S. economy that keeps on giving.

Trends in income growth and household formation, not surprisingly, carry through to home ownership. The growth of Latino home ownership has significantly outpaced that of Non-Latinos in every year since 2010. With an accelerating recovery from the Financial Crisis and Great Recession, the growth of Latino home ownership accelerated rapidly beginning in 2014 and has remained high in each year since. By comparison, Non-Latinos saw declining rates of homeownership through 2015. Although Non-Latino homeownership began to grow in 2015, growth remained below two percent in every year from 2015 to 2019 and then increased in 2020 but to a rate less than half that of Latinos.

The growth of Latino home ownership is one signal that Latino gains in human capital are increasing wealth as well as income. According to the Federal Reserve Board’s Survey of Consumer Finances, from 2016 to 2019, the median wealth of Latinos increased by 60 percent. During that same time, median wealth of Non-Hispanic Whites increased just 4 percent[2].

On top of the tremendous growth of Latino GDP between 2010 and 2020 and U.S. Latinos’ extraordinary economic contributions during the pandemic, these broad demographic trends indicate that Latinos will continue to be an engine of growth and a source of resilience for the U.S. economy for decades to come.

Matthew Fienup is Executive Director of the Center for Economic Research & Forecasting at California Lutheran University and Associate Professor of Economics. He earned his PhD from the Bren School of Environmental Science & Management at UC Santa Barbara. Matthew is an applied economist who specializes in econometrics, economic policy analysis, land use, and environmental markets. Matthew is also the Project Director for the Latino GDP Project.

The Center for Economic Research & Forecasting (CERF) is a nationally recognized economic forecasting house and a member of both the Wall Street Journal Economic Forecast Survey and the National Association for Business Economics (NABE) Economic Outlook Survey. In 2016, NABE awarded CERF second place in its annual Outlook Award competition. CERF’s quarterly U.S. GDP forecast was the second most accurate among more than 80 professional forecasts included in the survey. CERF economists Matthew Fienup and Dan Hamiton were also recipients of 2019, 2020 and 2021 Crystal Ball Awards for the Zillow Home Price Expectations Survey (formerly the Case-Shiller Home Price Expectations Survey). CERF's U.S. home price forecast received multiple-top-3 ranking among more than 100 forecasts. CERF works in partnership with researchers at UCLA on the Latino GDP Project, an ambitious multi-disciplinary research initiative which seeks to document the large and rapidly growing economic contribution of Latinos living in the United States.

The Latino GDP research has been presented live to more than 12,500 people in ten different states and the District of Columbia, including to the Joint Economic Committee of the U.S. Congress and to the Congressional Hispanic Caucus. The research has been covered in more than 120 separate features across print, digital, and broadcast media, including the Wall Street Journal, Barron's, MarketWatch, Forbes, Axios, NBC News, CNBC, MSNBC, the Hill, yahoo!finance, and Telemundo.

[1] 2020 LDC U.S. Latino GDP Report: http://blogs.callutheran.edu/cerf/files/2023/04/2022_USLatinoGDP_CERF.pdf

[2] Hernandez Kent, A. and L. Ricketts. 2020 “Has Wealth Inequality in America Changed Over Time?” Federal Reserve Bank of St Louis, Open Vault Blog. December 2020.