USD/CAD: The COVID-19 Currency Rollercoaster

By: Robert Bollé, Regional Manager - U.S. West Coast, AFEX

September 2020

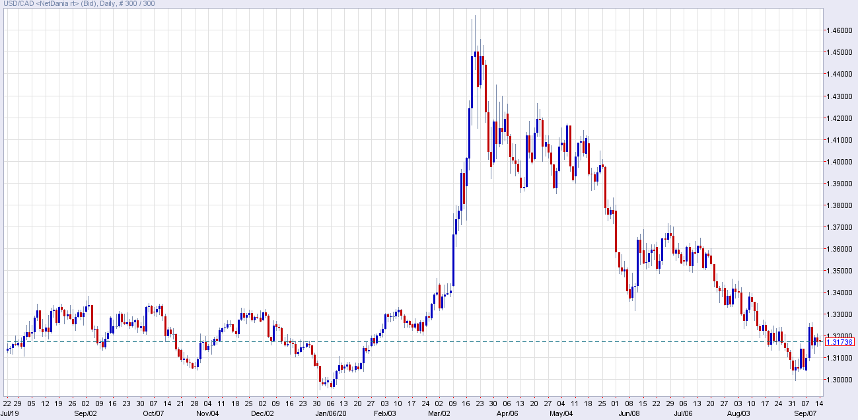

2019 was a relatively calm year for currency markets. For the second half of the year, USD/CAD exchange rates bounced around in a tight range and struggled to break below 1.3000, or higher than 1.3350. All very serene and, dare I say from a currency trader’s perspective, dull.

And then along came 2020.

As more news started to filter out of China of a new and deadly strain of coronavirus in January of this year, and governments across the world realized that its spread was rapid and far-reaching, we found ourselves in an unprecedented lockdown. Markets panicked and plummeted, Central Banks slashed interest rates and commodity currencies such as the Canadian dollar were hammered, as oil prices briefly went negative.

Volatility was back with a bang. Back to levels not seen in over a decade, since the Global Financial Crisis of 2008. Having sat in a trading range of around three percent, the loonie weakened against the greenback by a full ten percent in early March 2020 – spiking all the way up to 1.4660.

USD/CAD trading chart, July 22 2019 through September 14 2020.

With the United States reporting record job losses – millions upon millions of Initial Jobless Claims piling up each Thursday – and with the Federal Reserve taking no time in cutting benchmark interest rates from 2% to 0.25% (and thus diminishing the dollar’s investment appeal against most other major currencies), the US dollar would, in normal times, have weakened. But these are no normal times. When the markets are gripped with uncertainty, the US dollar strengthens as traders rush to ‘safe havens’.

By the end of August 2020, USD/CAD had settled back to the levels we saw in a COVID-19-free world. With the initial shock and awe subsiding, the Canadian dollar’s impressive recovery saw the interbank market rate retrace to just a few dozen ‘pips’ over 1.3000 again.

While market traders traditionally look to economic data (GDP, inflation, unemployment figures, retail sales, consumer and business confidence, etc.) to determine the strength of an economy and, therefore, the strength of a currency, we’ve seen a big shift to general sentiment affecting currency rates. A prime example of this is the current sell-off of the US dollar, back to pre-COVID-19 levels. Federal Reserve Chairman Jerome Powell outlined an “accommodative policy change” that is believed could result in inflation moving slightly higher, and interest rates staying lower for longer. In short, the Fed’s shift in inflation policy should keep US rates near zero for the foreseeable future, keeping the US dollar relatively weaker, since they are in no rush whatsoever to raise interest rates regardless of the speed of recovery for the US economy.

Members of MAPLE Business Council sit on both sides of the market. Members in the US, who buy their products or services from Canada, would have enjoyed enormous discounts – buying their Canadian dollars at the cheapest level seen since 2003. On the flip side, Canadian companies are typically more exposed to the value of the US dollar. Those of you who costed the USD/CAD exchange rate at, say, 1.3500 at the start of this year, would have found yourselves in a nasty offside position – with the cost of your US products or services increasing dramatically.

It’s fair to suggest that AFEX is something of a barometer for global business trends. As a global company, we help clients across the world to buy or sell their currencies and, importantly, manage their risk with hedging strategies. The industries we serve are vast and varied. At the beginning of the COVID-19 lockdown, we saw our trading volumes in all regions decline. Unsurprisingly, one of the worst affected industries has been travel and related services – an industry that ought to bounce back strongly just as soon as a vaccine is approved for general release. Quite when that will be is anyone’s guess right now. But the drop in volume may also be attributed to companies the world over sitting on their invoices, holding their cash for more important matters, like making month-end payroll, while they tried to figure out how their business would navigate a complete shutdown of offices.

Government programs rolled out in April to support small and medium sized businesses certainly boosted business confidence and as we all adapted to the work-from-home shift, it started to feel a lot more ‘business as usual’. So, while the volumes we traded troughed in March and April, there are promising signs that companies are adapting to the new normal.

What does the future hold?

In such uncertain times, it’s impossible to accurately predict what’s in store. Reported COVID-19 cases are on the rise again across the world, and so the light at the end of the tunnel is getting ever smaller for almost all major economies. What we can do is look to the Bank of Canada and the Federal Reserve as they meet in September and give their guidance. Market traders will closely scrutinize every word in their statements, and a bearish (negative) tone or sentiment will be pounced upon and likely soften the currency.

In Canada, officials have made it clear that while the economy has somewhat reopened, the road to recovery will be long, bumpy and uneven. The Bank of Canada has warned of a highly uncertain outlook and that the unprecedented ambiguity makes the future all but impossible to predict. Recent data points to a confirmation that the economy bottomed out in April of this year (assuming we don’t see an uncontrolled second wave of cases) yet a recovery will require a considerable amount of monetary policy support and stimulus. An ‘accommodative policy’ will remain in place until the BOC’s 2 percent inflation target has been sustainably achieved. ‘Sustainably’ is the key word here. Consumer and business confidence has been crushed by the COVID-19 crisis and will only bounce back once sustainable growth is achieved.

In an official statement, the Bank of Canada asserted that: “The pandemic will have largely run its course by the middle of 2022, because either a vaccine or an effective treatment is widely available by then. Our policy discussions were guided by this scenario, while recognizing the extreme uncertainty around these assumptions”. With this said, we could expect to see a burst of “exceptionally strong short-term growth” once the economy is gradually reopened, followed by a longer, slower period of consolidation and recuperation.

On Thursday September 10th, the Bank of Canada left its main interest rate unchanged at 0.25% - as universally expected - and maintained its quantitative easing program. Governor Tiff Macklem noted that while the Canadian economy has shown promising signs of growth, he expects the pace of recovery and improvement to slow. “Let me underline, it’s really very premature to start talking about exit. That’s some way off and that’s really reflected in our decision to continue our QE program at the current pace”.

The Federal Reserve in the US is also likely to maintain their policy of stimulus and low interest rates until they’re confident that inflation can be sustained above 2 percent.

With COVID-19 cases on the rise, it’s unlikely that the US dollar will weaken significantly any time soon. We have already seen the US dollar soften from its March/April peaks and so a period of consolidation could be expected. Remember – nervous markets rush to US assets in uncertain times (such as a fear of a second global wave of COVID-19), driving demand, and so we could see the greenback spike again.

But there’s something big on the horizon in the US, and as it gets closer, and polls are released, as debates are analyzed in microscopic detail, the market’s focus is going to be firmly on one thing: it’s General Election year!

We all have our opinions and, as a British expat with no right to vote, I will keep my opinions firmly to myself. What I will say is that markets tend to favor conservative governments. Polls pointing toward a Biden Democratic victory would, historically, weaken the dollar as traders fear for the strength of the economy – particularly now, as the world’s largest economy is in recovery mode. I can’t think of a time in living memory when elections were more difficult to call, or opinion polls as inaccurate as they have been, in recent times. And so until the exit polls are released on the evening of November 3rd, we should expect a bumpy ride for the greenback (followed by a sharp bounce one way or another, as the result becomes clear).

If you, or your business, is exposed to the USD/CAD exchange rate then know that there are a number of large and long-established currency trading companies who offer free consultation and trading services. The client Relationship Management team at AFEX in the United States and Canada proactively serve our clients and offer risk management, hedging products and currency trading guidance. Please contact me and I’ll be happy to personally help, or to introduce you to an AFEX currency specialist in your region.

Robert Bollé

Regional Manager – US West Coast

DD: 818-728-3846

Email: rbolle@afex.com