What’s Happening to the US Public Markets? Why US CEOs Should Look North for Capital.

By Delilah Panio, Vice President, US Capital Formation, Toronto Stock Exchange and TSX Venture Exchange

With the disappointing performances of recent IPOs including Uber and Lyft – both share prices have fallen significantly since their debut earlier this year – and the failed IPO of WeWork, US companies are left wondering if going public is still a viable funding option.

Once upon a time, the US public markets were open for business for small cap IPOs. Companies such as Microsoft and Apple went public with public offerings less than $100M. Today, the average IPO is around $250M and the number of IPOs are fewer and fewer. In 2018, there were 190 initial public offerings (IPOs) in the United States. While this was an increase from the past few years, it was half the number of twenty years ago, while the Dot Com bubble was forming.

Despite the introduction of the JOBS Act in 2012 which was meant to reduce regulatory burden and costs and to facilitate capital formation, US companies are staying private longer. The average time from first financing to IPO has increased from 4.8 years in 2005 to 6.6 years in 2019.

Investors backing these high growth companies – venture capitalists and private equity firms – are choosing to keep their portfolio companies private longer and tapping into more private capital sources for growth. This trend has several consequences that have an impact on the US entrepreneurial ecosystem and overall economy. When a company stays private longer, fewer people end up cashing in on these great American growth stories. If a company goes public earlier, the public has the opportunity to invest in and benefit from the upside as the stock grows. Today it’s often the VCs and PE investors that win.

The benefit of stock option plans to company employees is also impacted when the company stays private longer, as they are not benefitting from vested options along the way to buy homes or pay off debt. The big windfall of the IPO is less likely to happen now.

And, these companies are also not benefiting from the corporate governance regime that creates discipline especially on fiscal management. When a company goes public, it is required to have audited financial statements and a board of directors with an audit committee, as well as conduct quarterly reporting… all of which ultimately benefit the company and its growth.

North of the border, the Canadian capital markets are tailored to early stage companies seeking growth capital. TMX Group (TSX:X) owns and operates Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV), a unique two-tiered marketplace that has a 165+ year history of supporting and incubating small public companies.

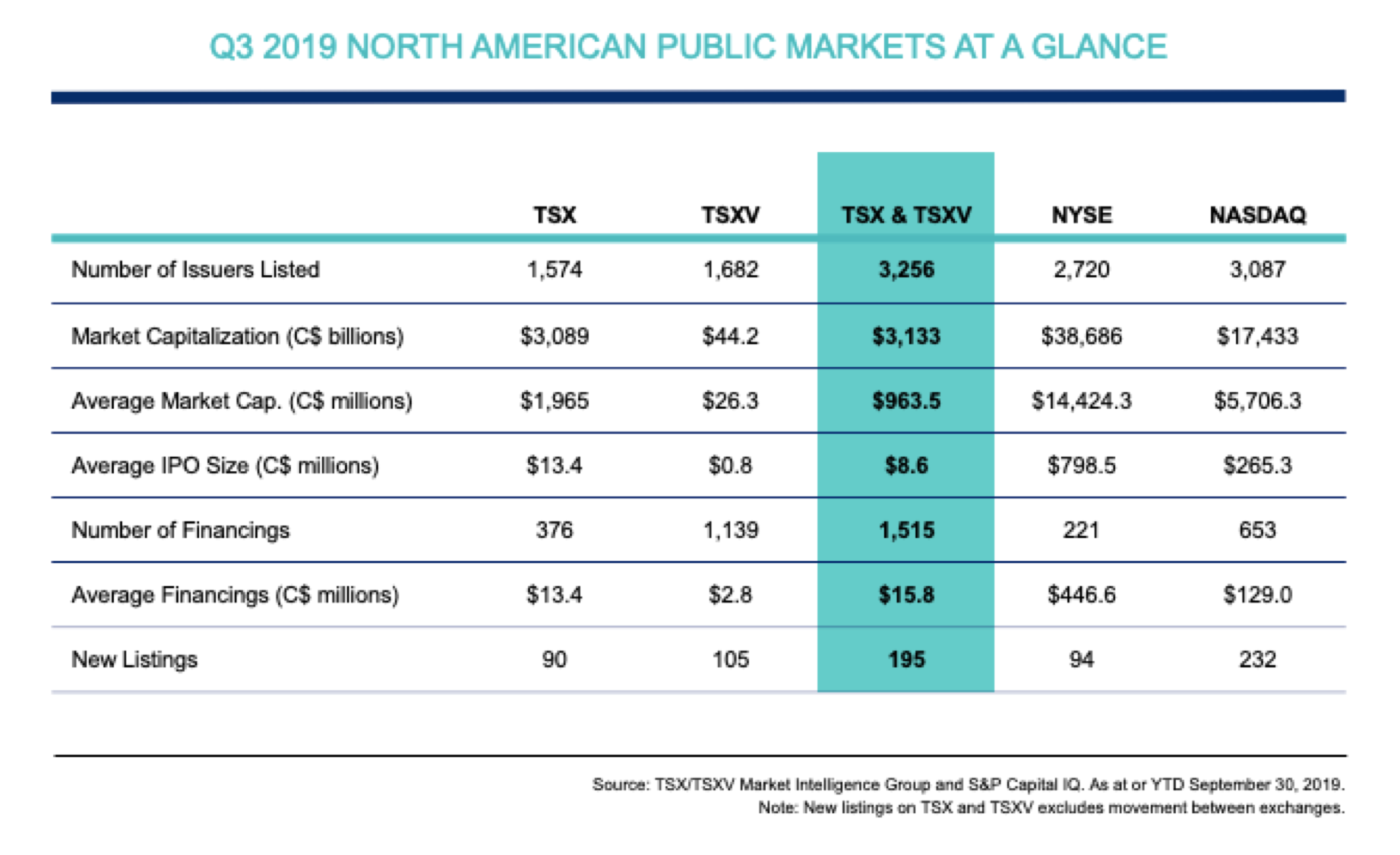

TSX is the senior market for larger, more stable companies with a track record. The average financings on TSX fall in the $25-$100M range and have an average market cap of $2.0B. These companies benefit from increased analyst coverage and being eligible for index products. For smaller, early stage growth companies, TSXV is a unique platform that is tailored to companies of this size. TSXV provides financings typically in the $5-$25M range and these issuers have an average market cap of just $26M.

Comparatively, Nasdaq and NYSE today service much larger companies with the average market cap of their listed issuers at $5.7B and $14.4B respectively. This table also shows the difference in the number and average financings, indicating TSX and TSXV’s platform for “public venture capital”.

So why does this matter to US companies? Because TSX and TSXV have listing requirements and corporate governance that are “right-sized” for growth companies. The opportunity to access public venture capital through the Canadian capital markets is an increasingly viable alternative.

Currently, over 100 US companies are listed on TSX or TSXV collectively raising $9B in the last five years. 35 new US listings came to market in this same time period. And six of the 2019 TSX Venture 50, which ranks the top performers on TSXV, are based in the US.

Los Angeles-based OjO Electric (TSXV:OJO) recently listed on TSXV, raising CDN$8M to fuel the growth of its electric scooter business. “At OjO, we’re proud to drive the micro-mobility revolution and are changing rideshare for good. We are thrilled to list on TSX Venture Exchange and now have a solid base from which to accelerate our product roadmap and market penetration,” said Max Smith, CEO.

For US companies seeking Series B+ growth capital, here are a few things to consider:

Know your funding options. There are many sources of growth capital available to US companies, including angel investors, venture capital, private equity, venture debt, equity crowdfunding, the over-the-counter (OTC) public market, and senior stock exchanges Nasdaq and NYSE. And there is “public venture capital” on TSX and TSXV. Be clear on what you are building and why, and evaluate the pros and cons of each option. Consider these factors: cost of capital (debt versus equity), maintaining control, alignment with the long term vision for the company, time and cost of reporting requirements, and value-add that comes with the capital (contacts, advice, industry expertise).

Understand public venture capital. Learn about the uniqueness and opportunity in public venture capital and the potential benefits of using the Canadian public markets to grow your company. Rather than taking on the potentially onerous terms of private equity or venture capital, consider that you can likely maintain greater ownership and operational control by going public on TSXV.

Have a reason to go public. Ensure your company would benefit from being public, including: access to capital; acquisition currency; incentive for attracting and retaining top talent through stock options; diversified shareholder base and flattened cap table; and the credibility and profile of being listed on an internationally recognized stock exchange.

Focus on long term growth. Once public, the most successful CEOs focus on executing the company’s business plan and less on watching the stock price. It is critical to manage investor expectations by communicating your companies long term strategy and by investing in quality investor relations.

TSX and TSXV are a unique funding and listing platform for high growth US companies looking to raise Series B+ capital. Companies with early revenue, a strong management team, and a growth strategy to eventually list on a US exchange should consider the Canadian capital markets as an alternative that may be the right fit.

For more information, contact Delilah Panio, VP of US Capital Formation, Toronto Stock Exchange, at delilah.panio@tmx.com.